Will Your Retirement Savings Last?

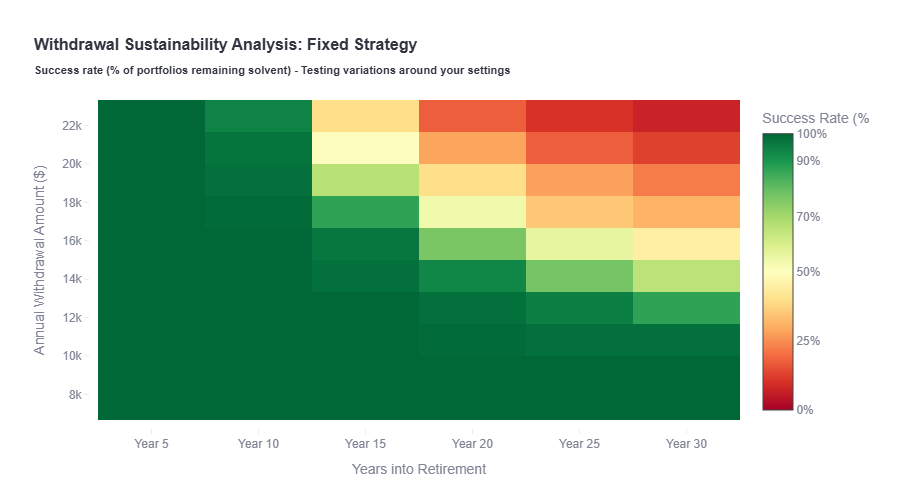

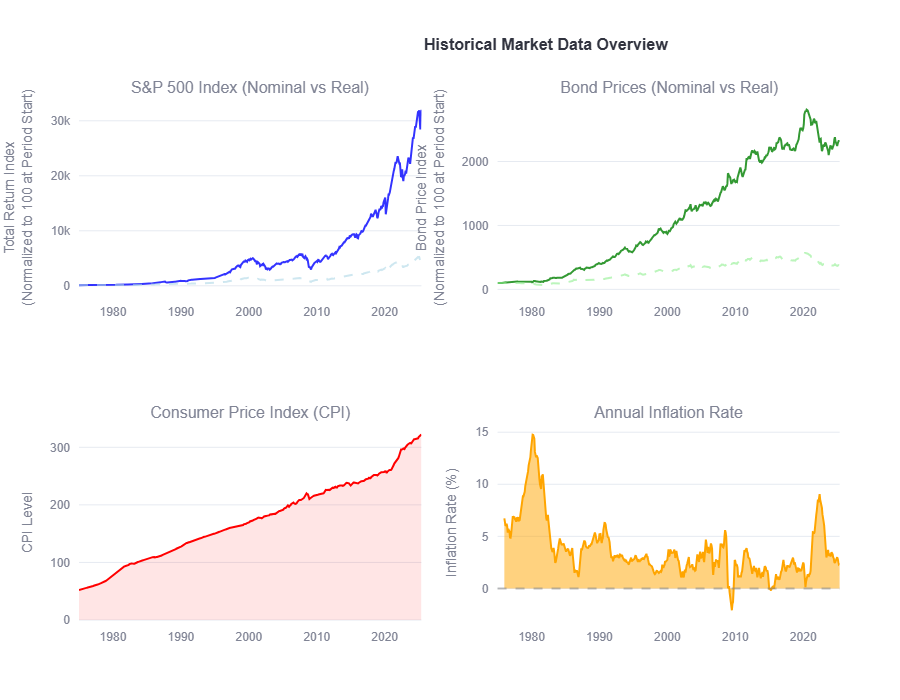

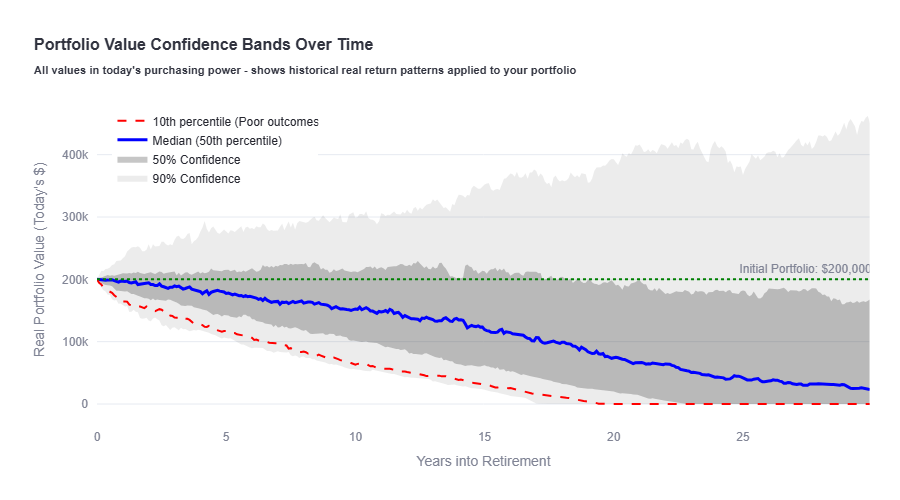

Test your retirement plan with 150+ years of historical market data. Run Monte Carlo simulations, analyze withdrawal strategies, and plan with confidence using professional-grade tools.

Powered by rigorous data analysis